|

| Loans You Should Know About. |

Things That You Should Know About Loans

Sometimes in life, you may go through situations where you may need a loan to make your dream come true for your family or business organization. In this situation, it is a great asset to have a high credit score. A high credit score can help you to get a lower interest rate as long as you have proof of the financial ability to repay the loan.

A loan can be defined as something borrowed and expected to be paid back with some interest and maybe some extra charges in the future. Not everyone can be approved for each type of loan available to the public.

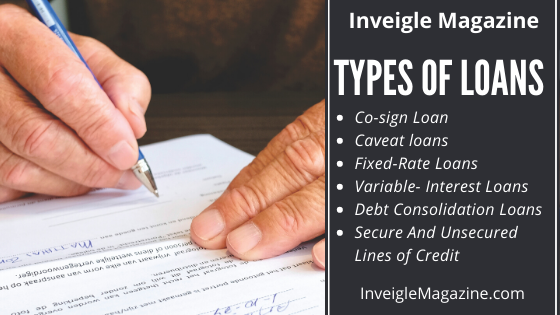

Types of loans:

|

| Some Types of Loans |

1- Co-sign Loan

A co-signer agrees to pay the debt of the borrower for which they cosign for if they default on the loan.

Reasons people may co-sign:

- It helps the other person (applicant) build their credit. (Ex. Your child may just be starting in life. If you feel they are responsible and will make the payments, you may consider the option of co-signing.)

- It helps an applicant secure financing. (Ex. The applicant may have poor credit. Be careful and try to find out if the applicant has changed their way of honoring their obligation to pay. If not, it can hurt your credit.)

2- Caveat loans

Caveat Loans are taken out for a very short period. For instance, 1-12 months, and they are usually settled quickly.They can be beneficial in helping with cash flow problems, Paying off tax debt, Covering up unexpected cash financial loss, upcoming business opportunities, and more.

Benefits And Drawbacks Of A Caveat Loan

- "Quick access to finance. Some caveat loans can be approved within one or two hours.

- Flexible loan amounts. You can generally borrow from $1,000 to $50 million, depending on the value of your property.

- Little documentation required. Unlike regular business loans, you do not generally need to provide evidence of your trading history and revenue or other business details.

- High rates. Caveat loans offer higher interest rates than normal business loans. Unlike other business loans, interest is also generally calculated on a monthly basis.

- Short loan terms. You are generally required to pay back the loan within 1 to 12 months.

- Requires property as security. You will need to use your property as collateral against the loan in order to be eligible.

- Higher risk. if you fail to repay the loan, the lender can take ownership of the property (or the amount of equity you used as security)."

3- Fixed-Rate Loans

With a fixed-rate loan, the interest rate does not change over time. It remains the same.

The benefit of a Fixed-rate Loan

The benefit of a fixed-rate loan is that you always know what your payment will be. Interest rates may increase as the economy grows, but with a fixed-rate loan, the interest rate on your purchase is protected from rising to higher interest rates. If you already know what to expect your loan payment to be, it helps you budget those future payments. Imagine buying a house. What type of loan would you want?The downfall of a fixed rate Loan

The downfall of a fixed-rate loan is that it may begin with a more expensive rate. Although if the interest percentage is moderate at the time, you can be locked into a good price. Therefore, you have to decide if you wish to use a fixed rate where you can budget your bills without worrying about the payment jumping to an amount that you can't afford, or use a variable rate that may start at one credit rate and then changes to a higher rate.Amortization Calculator

You can use the calculator to see how various interest rates can affect your total purchase price; as well as, the payment price.

4- Variable- Interest Loans

Variable-interest loans have interest rates that change over time. If your interest rate changes, that will make the price of your purchase rise, potentially causing you to spend more in interest without any added benefits from the purchase. The value of the item you purchased will not go up, but the price you pay will.

5- Debt Consolidation Loans

Lines of Credit

A line of credit is when you are given an established sum of money in which you can borrow against as needed. It is similar to a credit card. The interest is paid as you spend the money.

6- Secured Line of Credit

A secured line of credit is when you promise an asset as collateral.

Some assets used for collateral

- A savings account

- Real estate

7- Unsecured Lines of Credit

Now that you know some types of loans, make sure to use them responsibly. Have a wonderful day and check out this article on mortgage insurance.

Author: Arica Green (Arica G) is the Founder and Editor of Inveigle Magazine. She created a premiere Lifestyle, Fashion, and Beauty Magazine to entice you towards positive change and increase the quality of life. With Arica's love for writing and informing the Universe about a variety of topics, Inveigle Magazine was born.

don't want to miss any of our popular,

and informative articles, so sign up promptly for article updates right to

your email to let you know another article

has arrived on Inveigle magazine for your

enjoyment. It's free!

Inveigle Magazine